Do Your Banking with a Chatbot

Do Your Banking with a Chatbot

Kasisto’s AI platform is powering a mobile-only bank in India, where chatbots handle all consumer requests.

People in India can now open an account with a bank that’s only accessible via mobile devices. Called Digibank, it’s staffed by chatbots intelligent enough to answer thousands of questions submitted via chat.

The machine-learning-based technology is a product of Kasisto, a New York startup that spun out of the company that created Apple’s Siri assistant. Kasisto trained its KAI artificial-intelligence platform with millions of questions asked by customers during their banking experiences.

“A lot of the bots that are out there are what we would consider ‘dumb bots.’ It’s very easy to break them, and it’s very easy to ask an out-of-context question, and they just don’t know how to handle it,” says Dror Oren, Kasisto vice president of product. “What we’re building is very, very unique in its ability to create real conversations.”

Facebook brought chatbots into the public eye last month when it integrated the digital assistants into its Messenger platform. But researchers are far from perfecting chatbots’ ability to hold a conversation. After Microsoft debuted a Twitter bot called Tay that learned to converse from the people who interacted with it, the Internet quickly taught it to say nasty things (see “Microsoft Says Maverick Chatbot Tay Foreshadows the Future of Computing”).

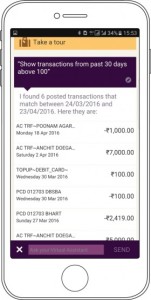

Via a chat box, users can ask the KAI-generated banking bots a customer-service-related question. Or they can give the bot a command like “Pay Jennifer $25 for dinner yesterday” and it will respond with requests for more instructions. If transferring money would result in an overdraft, it can alert the user and ask if he’d like to move money between accounts.

One of KAI’s strengths is its ability to entertain multiple channels of conversation at once.

One of KAI’s strengths is its ability to entertain multiple channels of conversation at once.

“Most systems will guide you through the payment on a rule-based system,” Oren says. “But in our system, instead of just saying, ‘Use Venmo,’ you can actually say something that’s completely out of context. The system comes back and asks, ‘Which account do you want to pay out of?’”

After digesting examples of real conversations from customers’ interactions with banks, KAI uses statistical classifiers to quickly figure out what topic a customer is broaching. One of KAI’s strengths is its ability to entertain multiple channels of conversation at once. If a user holds a conversation with a bot and then in the middle asks a question about something totally unrelated, the bot knows to answer the question and then return to the original topic of discussion. KAI can recognize different intents and separate them without becoming confused, just like a human.

Matt Swanson, a managing partner at Silicon Valley Software Group and former founder of SpeakerText, describes chatbots as a new medium for communication. Traditional banks with online presences tend to make customers dig for how to reach customer-service representatives—generally via a call or live chat.

But bots are slowly making inroads at other financial institutions. RBS, for example, is preparing to use an AI called “Luvo” to help customers with basic requests, though complex customer-service questions will be passed along to a human. Bank of America also allows customers to interact with a bot on Facebook’s Messenger platform.

Digibank is the first to rely so heavily on a chatbot. It is an integral part of the banking experience—not just a face to turn to when there’s a problem. A customer can go directly from performing an action to seeking an answer to a question without interrupting the flow of what they are doing.

Using text instead of voice also means the bot can accomplish far more sophisticated actions, according to Swanson.

“Text is a much easier machine-learning problem to solve than voice,” Swanson says. “It’s almost like the difference between digital and analog. With text-based interactions you have a very explicit set of inputs. A text really makes a cleaner starting point for machine-learning or natural-image-processing algorithms.”

Kasisto plans to adapt KAI to banking-related industries such as wealth management and workplace benefits. It could also see a wider rollout, as the software is built to adapt to any space—as long as the AI is trained on related questions.

Leave a Reply